TN DoR RV-F1301101 2008-2026 free printable template

Show details

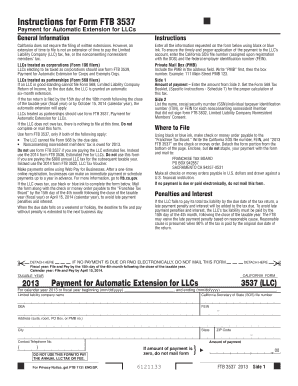

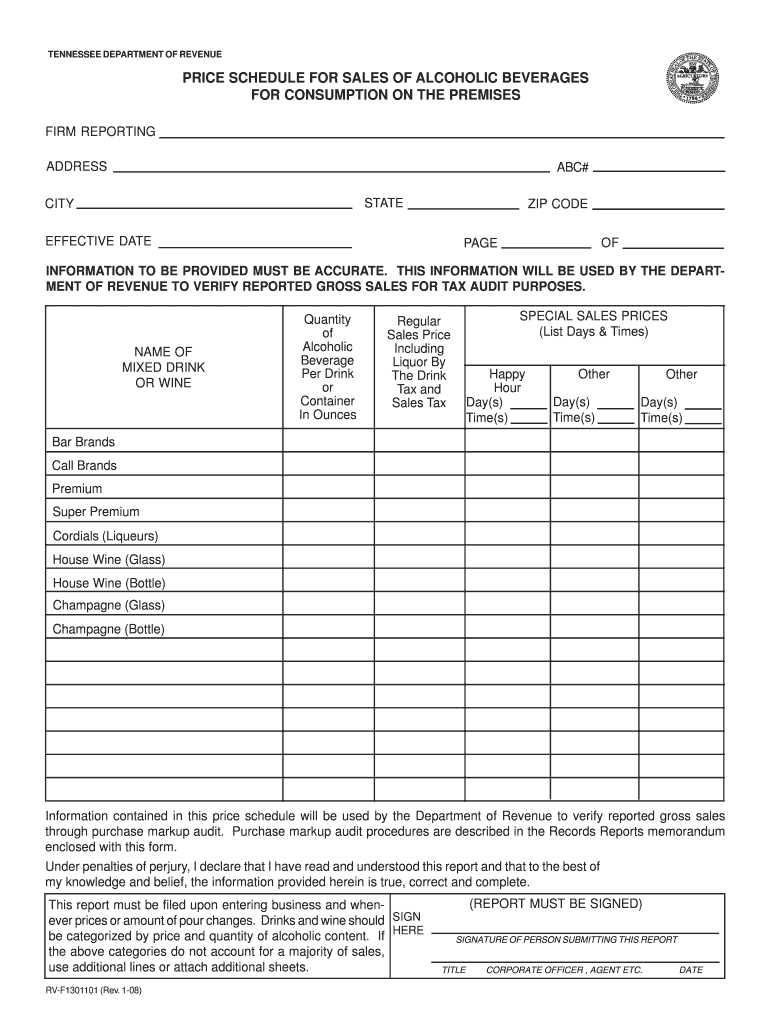

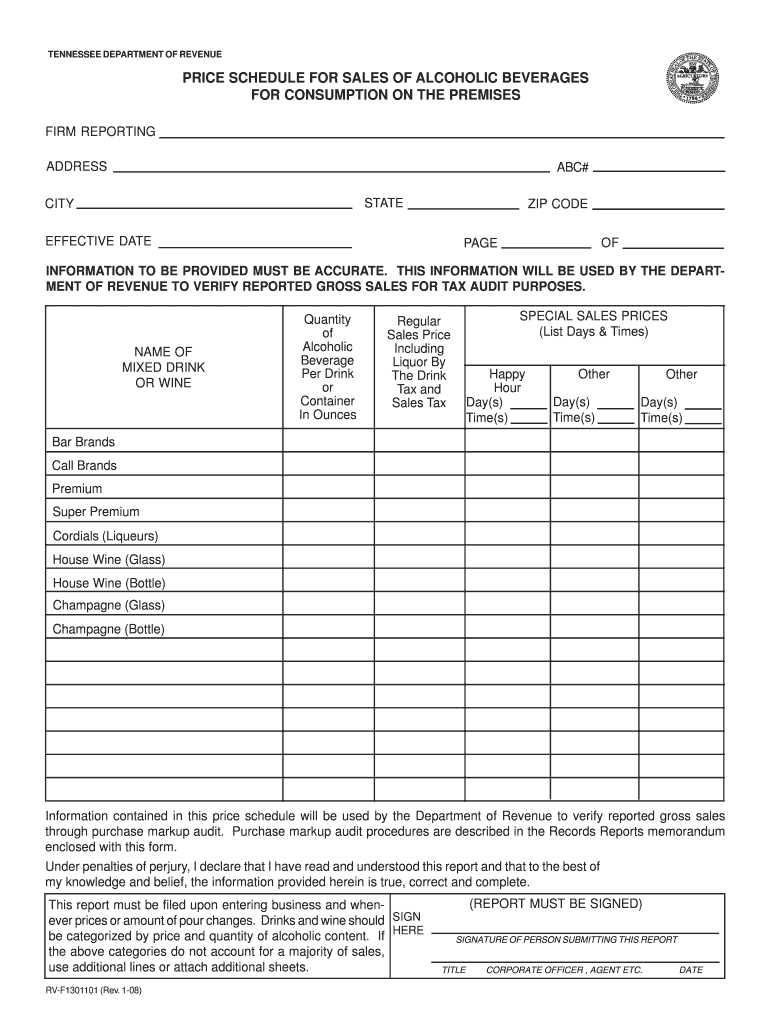

TENNESSEE DEPARTMENT OF REVENUE PRICE SCHEDULE FOR SALES OF ALCOHOLIC BEVERAGES FOR CONSUMPTION ON THE PREMISES FIRM REPORTING ADDRESS ABC STATE CITY ZIP CODE EFFECTIVE DATE OF PAGE INFORMATION TO BE PROVIDED MUST BE ACCURATE. THIS INFORMATION WILL BE USED BY THE DEPARTMENT OF REVENUE TO VERIFY REPORTED GROSS SALES FOR TAX AUDIT PURPOSES. NAME OF MIXED DRINK OR WINE Quantity of Alcoholic Beverage Per Drink or Container In Ounces SPECIAL SALES PRICES List Days Times Regular Sales Price...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign printable liquor rebate forms

Edit your tn dor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tennessee annual report form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TN DoR RV-F1301101 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TN DoR RV-F1301101. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out TN DoR RV-F1301101

How to fill out TN DoR RV-F1301101

01

Obtain the TN DoR RV-F1301101 form from the Tennessee Department of Revenue website or your local Department of Revenue office.

02

Fill in your personal information, including your name, address, and contact details.

03

Indicate the type of application you are submitting on the form.

04

Provide any necessary vehicle details, such as the make, model, year, and VIN (Vehicle Identification Number).

05

Include any required additional documentation, such as proof of ownership or identity.

06

Review the filled form for accuracy and completeness.

07

Submit the form either online (if applicable) or by mailing it to the appropriate address listed on the form.

Who needs TN DoR RV-F1301101?

01

Individuals applying for vehicle registration or title in Tennessee.

02

Residents who need to document ownership or transfer of a vehicle.

03

Anyone seeking to renew their vehicle registration or update their vehicle information.

Fill

form

: Try Risk Free

People Also Ask about

What is the alcohol tax in Nashville Tennessee?

Mixed drinks purchased on Broadway are taxed the same throughout the county, with the 15% liquor-by-the-drink tax and the 9.25% sales tax. In addition to routine sales tax (9.25%), the liquor-by-the-dink tax is imposed on liquor, wine and high-alcohol content beer — defined as 9% alcohol or more.

What is LBD tax in TN?

Liquor-by-the-drink licensees may offer drive-through, pickup, carryout, and delivery orders of alcoholic beverages for consumption off the premises until July 1, 2023. The 15% liquor-by-the-drink tax should be collected on these off premises sales.

What is the liquor tax in Nashville Tennessee?

Mixed drinks purchased on Broadway are taxed the same throughout the county, with the 15% liquor-by-the-drink tax and the 9.25% sales tax. In addition to routine sales tax (9.25%), the liquor-by-the-dink tax is imposed on liquor, wine and high-alcohol content beer — defined as 9% alcohol or more.

Does Tennessee charge tax on alcohol?

Tennessee levies a tax on every gallon of alcoholic beverages sold or distributed in the state. Generally, this tax is paid by wholesaler distributors. Depending on the manner of distribution, manufacturers, common carriers, direct shippers, and wineries may be responsible for collecting this tax.

Does TN have a liquor tax?

Tennessee levies a tax on every gallon of alcoholic beverages sold or distributed in the state. Generally, this tax is paid by wholesaler distributors. Depending on the manner of distribution, manufacturers, common carriers, direct shippers, and wineries may be responsible for collecting this tax.

How much is liquor tax in TN?

✔ Tennessee's general sales tax of 7% also applies to the purchase of liquor. In Tennessee, liquor vendors are responsible for paying a state excise tax of $4.40 per gallon, plus Federal excise taxes, for all liquor sold.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit TN DoR RV-F1301101 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing TN DoR RV-F1301101 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out TN DoR RV-F1301101 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign TN DoR RV-F1301101 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit TN DoR RV-F1301101 on an Android device?

You can make any changes to PDF files, like TN DoR RV-F1301101, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is TN DoR RV-F1301101?

TN DoR RV-F1301101 is a specific form used by the Tennessee Department of Revenue for reporting vehicle registration information and related taxes.

Who is required to file TN DoR RV-F1301101?

Individuals or businesses that own vehicles in Tennessee and need to report vehicle registration and related taxes are required to file TN DoR RV-F1301101.

How to fill out TN DoR RV-F1301101?

To fill out TN DoR RV-F1301101, you should provide all requested information, including vehicle identification details, owner information, and applicable tax calculations. Ensure that all fields are completed accurately.

What is the purpose of TN DoR RV-F1301101?

The purpose of TN DoR RV-F1301101 is to facilitate the reporting and payment of vehicle registration fees and taxes to the Tennessee Department of Revenue.

What information must be reported on TN DoR RV-F1301101?

The information that must be reported on TN DoR RV-F1301101 includes vehicle identification number (VIN), make and model of the vehicle, owner's name and address, and any applicable fees or taxes owed.

Fill out your TN DoR RV-F1301101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TN DoR RV-f1301101 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.